5 Credit Card Risks Every Smart Spender Needs to Know

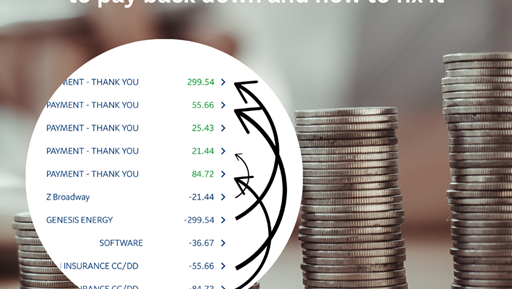

The 5 Biggest Risks of Putting All Your Expenses on a Credit Card Using a credit card for all your expenses can be a smart way to manage your finances, earn rewards, and build credit—if done responsibly. However, relying solely on credit cards with the plan to pay off the balance in full at the end of the month comes with risks. Here are the five biggest pitfalls to consider:1. Overestimating Your Ability to Repay in Full Relying entirely on your credit card often results in underestimating how much you’ve spent throughout the month due to the number of small purchases and transactions you make. These can add up a lot quicker than you realise. Larger unexpected expenses, like medical bills or car repairs, can sabotage your ability to pay the balance in full and once you roll over into the following month with a balance, the high interest rates on credit cards make paying off the debt much harder than anticipated. For many people the reason this occurs is that they have built the habit of paying for their expenses ahead of actually earning the money so there is no other way to pay for current expenses except with the credit card. Solution: Set yourself a weekly spending review to monitor your balance and what you spent that week. Knowing what you have spent already helps you think a little more strategically about where you might be able to reduce spending in the week that follows. 2. Falling into the “Revolving Credit Trap” Credit card companies remain profitable because the majority of people at some point become indebted to the stage that they can now only pay the minimum balance each month. You are now caught in the revolving credit trap, where you’re only making small dents in your balance while paying significant interest. Solution: Have a budget or plan that identifies clearly for you how much your expenses are each month and then reduce your card limit to reflect this amount. That way you remove the risk of becoming over indebted. Ensure you are building an emergency fund as part of your financial plan. Then if any larger unexpected expenses occur you can immediately move funds from your emergency savings account onto your credit card to avoid becoming stuck in debt. 3. Increased Risk to Fraud While credit cards often come with fraud protection, challenging any charges you know you didn’t make can be both stressful and costly. Especially if a significant amount of your available credit has now disappeared while you try and get the transactions investigated and resolved and you are in that cycle of needing the money to pay your ongoing expenses. Solution: Review your credit card statements weekly for unauthorised charges. Set up real-time transaction alerts to monitor activity. 4. Letting Rewards and Benefits drive your spending behaviour Credit card rewards can be attractive, but chasing points, miles, or cashback often leads to unnecessary spending. You rationalise your purchases as a good thing ultimately costing you more than the value of the rewards. Solution: Accept rewards as a bonus, not a spending motivator. Your spending should always be in line with what you have to spend anyway and therefore any rewards were simply a consequence of that. 5. Dependence on Credit for Lifestyle Maintenance Relying purely on a credit card creates a dangerous habit of living beyond your means. At the point your spending exceeds your income and you are now depending on credit to maintain your lifestyle, it’s only a matter of time before you find you have entered a season of debt dependency. This then creates financial stress and leads to long-term financial instability. Solution: Only use your credit card for reoccurring fixed expenses like utilities and insurances and develop the habit of using your own money or cash for discretionary spending which will help you reinforce good spending habits and be more mindful of how much you are actually spending through the course of a month. A Timely Reminder Credit cards offer convenience and rewards however they require disciplined management. Being aware of these risks and implementing strategies that can help you avoid the financial pain that follows when you haven't actively managed your credit card isn’t an overnight success. It requires a clear plan and an even more disciplined approach to get out of debt than what you would have needed to apply in order to avoid it in the first place. If you want to create a plan to get your credit card back to where it should be and avoid the additional interest it is costing you, you can use this handy calculator to work out a payment strategy. Or if you prefer, you can always reach out for some personal support, just schedule a Free Discovery Call and we can explore how I can help.

Why we struggle to save money

Join me in a conversation. For anonymity I will call you Alex. Alex: (sipping coffee) You know, Tony, I’ve been trying to figure out why it feels so hard to save money. I mean, I have a decent income, but it feels like I’m constantly running in circles. Tony: (nodding) Trust me, you’re not alone. It’s not just about how much you earn—it’s how banks and companies have designed the system. Honestly, a lot of it comes down to how they profit from our lack of understanding and subconscious spending habits. Alex: (frowning) Lack of understanding? What do you mean? Tony: Think about it. Banks make most of their money through fees and interest. Overdraft fees, late payment penalties, credit card interest—those things add up. And who’s most likely to fall into that trap? People who don’t fully understand how money works or don’t have a solid financial strategy. Alex: (leaning in) Okay, but how do they get us? Tony: Marketing. Clever, psychological marketing. Ever notice how we are constantly bombarded with options of credit cards with rewards programs or offer “buy now, pay later” plans? They know the truth that most people won’t pay off their balance in full every month and those that do only ever do for a short period of time before they too find themselves carrying a balance, now stuck paying them interest—sometimes upwards of 20% or more. Alex: (surprised) Wow. So, they’re profiting off our bad habits? Tony: Exactly. And it goes deeper. Millions of dollars are continually spent by companies studying human behaviour. They know we’re emotional creatures. That’s why you see ads that make you feel like you deserve that new outfit or the latest gadget. They tap into our desire for instant gratification. Alex: (sighing) And then we swipe the card or sign another loan agreement without thinking about the long-term consequences. Tony: Yep. And banks count on that. I think the most subtle and expensive trap is how they rarely ever talk about how they will help you pay off your mortgage sooner they just hope the financial pressure you are feeling will cause you to make one of the most costly mistakes which is to refinance. They wave under your nose a lower interest rate. And most people take the bait when the interest rate has nothing to do with helping them get out of debt sooner. Alex: (thinking) And here I thought they were just being helpful. Tony: (laughs) They’re helping themselves, not you. The truth is, it’s a cycle. You spend without planning, end up with debt, and then feel stuck because the system keeps you there. Alex: So, how do we break free? Tony: First, awareness. Understand the game being played. Banks and businesses aren’t evil—they’re just doing what they’re designed to do: make a profit. But you don’t have to play their game. Alex: (curious) What’s the alternative? Tony: Learning to understand the system and manage your money smarter. Once you start doing this the right way, then tracking your expenses starts to pay off. Having a clear budget and plan goes past the numbers and actually starts to make a financial difference that you can benefit from. People I coach normally have the start of their emergency fund in place in a matter of weeks so they can become less reliant on credit when unexpected costs come up. Alex: (nodding) That makes sense. Tony: Also, be mindful of emotional spending. Before buying something, ask yourself: Do I really need this, or am I just trying to feel better about something? Alex: (smiling) Wow, Tony you should write a book or something. Tony: (grinning) Funny you say that. I did. Helping people like you understand this stuff makes a huge difference to their lives. Alex: This chat’s really got me thinking, I need to get a copy of your book and get out of this cycle I have been stuck in for far too long now. Tony: That’s a great starting step Alex, investing in yourself is one of the best investments you will ever make. Alex: Thanks, Tony. Tony: Anytime. Hey quick question, I noticed when you bought your coffee you waved your card over the terminal to pay, why did you do that? Alex: It just keeps life simple. Tony: So you know what we talked about? Habits and human behaviour. Did you know Covid had us start behaving that way, contactless payments we adopted out of the promotion of the benefits amidst a pandemic. And it made sense. But here’s the thing, in the beginning it didn’t cost you anything to pay this way. Alex: Oh yeah I’m aware we pay now, but it’s very little so for the convenience I don’t mind. Tony: Really? Have you stopped to calculate what it actually costs you? I’ve worked it out and the average person is paying close to $1,200 a year on these fees. That’s $100 a month you could get back starting today if the only change you made was to switch off payWave and start taking a moment to punch your pin number in instead. What’s could you do with an extra $1,200 a year? Enjoy the book, and you know how to find me if you want some help fast tracking your progress and understanding what other simple changes would benefit you personally. Alex: Thanks Tony, I’m starting to understand why your clients speak so highly of you. This short conversation has already made a huge difference. Check out my book here

Is refinancing my mortgage the best decision?

Refinancing your mortgage might seem like a great option but for many people it’s actually not. We all have those hindsight moments in life right, I will never forget that moment for a couple I met just after the GFC. Their hindsight moment was realising that the true cost for them from the previous two decisions to refinance was just shy of $600,000. It’s a costly mistake that anyone can make. This article covers some key questions to ask yourself before you head down the refinance decision so you can avoid costly mistakes and be confident in your choice whether that’s to refinance or stay with your current lender. Here’s five questions worth asking yourself when evaluating if refinancing is the best option for you.

Why won't the bank lend me money?

If I had a dollar for every time I have been asked this question I could probably be a bank myself. “I earn good money”, "I have a good deposit” and even “My mortgage payments would be less that what I pay in rent” are probably the most common statements people voice when they are asking me this question. And even though lenders may differ in their processes, they all have a requirement to meet their responsibilities under the ‘Responsible Lending Code’. So imagine yourself in this situation You are relaxing at home one Sunday evening when there’s a knock on the door. Upon opening the door, you are greeted by...