The 5 things everyone needs to know to budget successfully and get ahead financially

The art to successful budgeting

For most people deciding to make a budget is then followed by making a list of income and expenses because that's what they heard somewhere and it is absolutely the wrong place to start.

Unless of course you only want your budget to work for a couple of weeks.

There’s a right process for creating a successful budget or plan as I like to call it, and making a list isn’t it.

Now I know you are looking for the solutions but also theres a likelihood you are also thinking is this webinar going to make any difference? How is this different to anything you have tried before?

I guarantee it will make a difference and it is nothing like you have tried before, read my testimonials but you can’t find that out for yourself if you don't attend right.

Register your interest now and I will send you some additional information with the dates for the next workshop and how to get registered.

How will this FREE Webinar help me?

(Watch the video below)

You will not be asked to share any personal finance information on the webinar

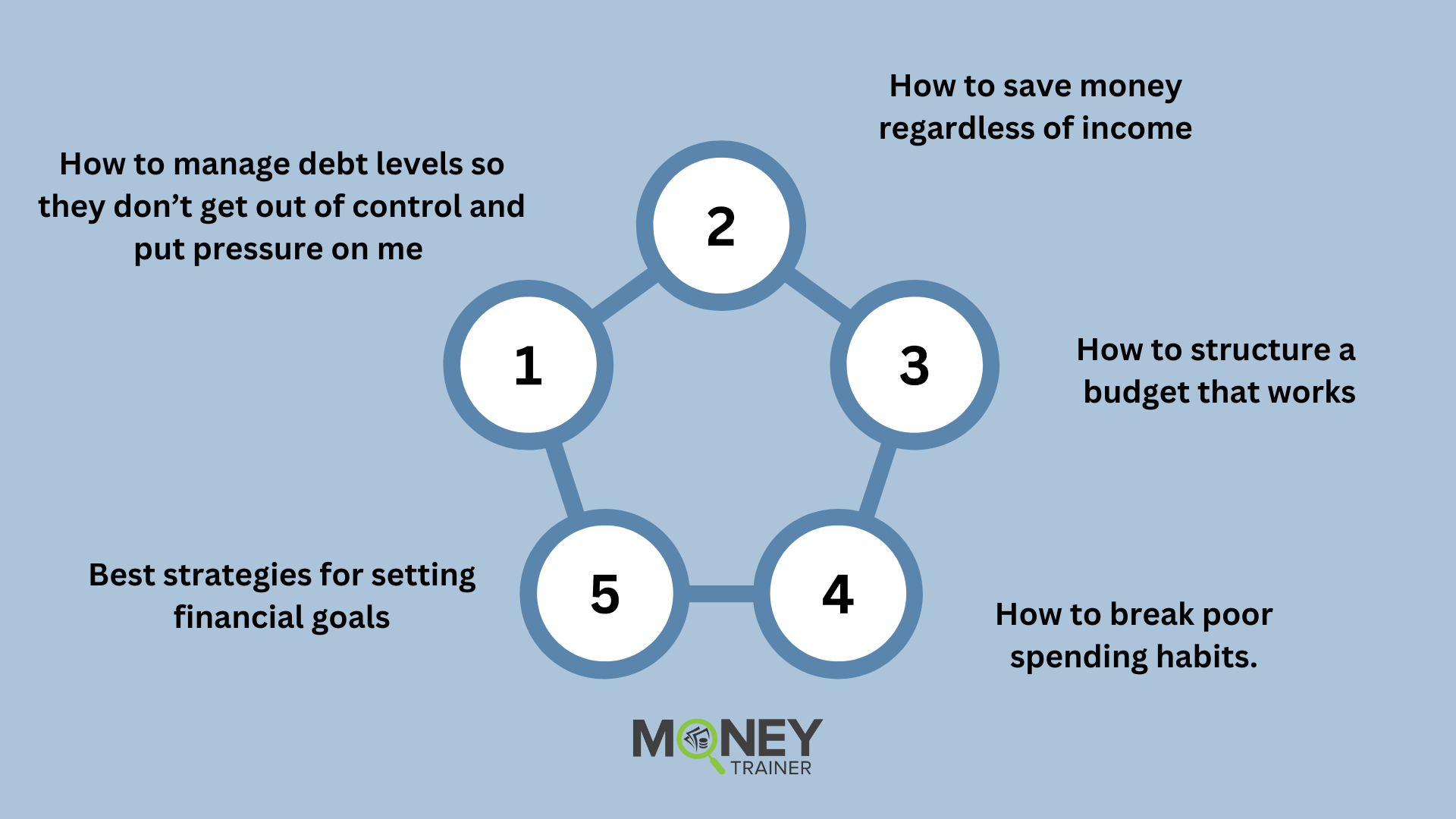

You are going to learn the following

- How to establish your own tolerance for debt

(What lenders don't tell you) - How to save money consistently

(A proven formula that works for everyone) - How to structure your budget correctly

(Know exactly where your money will be going) - How to identify and break not so good habits

(These are sabotaging your future) - How to set financial goals with confidence

(You deserve to have the success)