WHY YOU NEED TO START A 'RAINY DAY FUND'

3 August 2021

If you already have a rainy day fund then well done, you probably don't need to read on however if you don't yet have one or your just starting to think about building one, I want to share with you today the 3 main reasons I believe it is vital everyone starts building one as soon as possible.

Why is it more important now more than ever to get started

And don't panic if you know you should have one but don't know how to get started, I will give you a simple process you can use to make it happen regardless of your circumstances.

1. Banks are tightening their belts

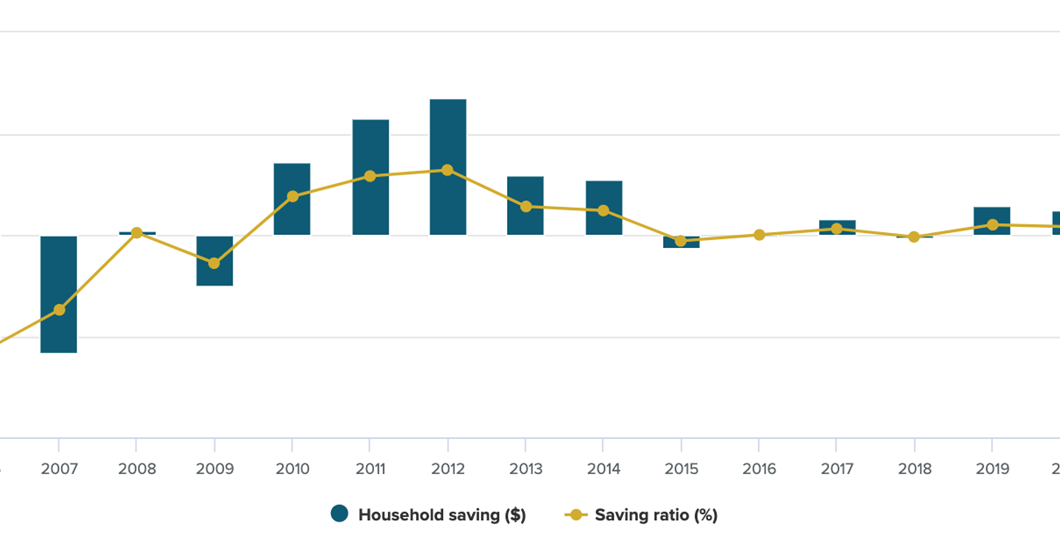

What I mean by this is that since 2015 banks have had a field day dishing out money and as the graph shows they have done a great job at keeping the economy indebted to the point where the ability to save has been non existent.

It's a fine balance, the more debt you have, the less your ability to save. On the other hand the more savings you have the less need for debt and banks understand this well, after all they make their money by selling debt not teaching you to save.

Now that the reserve bank is talking about possible OCR rate increases banks have been provided the perfect opportunity to start saying no to new borrowing particularly when it comes to consolidating exisiting loans or personal loans that aren't attached to mortgage securities.

This means for most people 2nd tier lenders may become their only option which of course incurs higher interest rates and puts further pressure on one's finances.

2. Living Costs are continuing to increase

I don't know about you but here where I am in Auckland I have seen fuel costs now hitting $2.40 a litre on occasion where three months ago the average was $2.15.

We will continue to see increases right across the board as the cost of transporting and importing goods gets passed down to the consumer.

The current situation was perfectly summed up in the heading from a recent article, 'Perfect Storm' Cost of living rises .8% and tipped to increase further (click the link if you want to read the article)

And if history has shown us anything we know that wages aren't increasing in line with the increase we continue to experience with living costs.

3. A Rainy Day Fund will help you navigate the unexpected

In life we have what I refer to as the 'Expected' unexpected and the 'Unexpected' unexpected.

That's a mouthful, let me unpack if for you so it makes sense.

The 'Expected' Unexpected

These are expenses like the car needing new tyres or appliance guy needed to repair a faulty washing machine, worse still replace it completely.

While these expenses aren't an every day occurrence they will happen so they should never be unexpected and a good budget/plan is the best way to prepare for these a 'Rainy Day Fund' can be just as beneficial.

The 'Unexpected' unexpected

These are expenses such as last minute travel costs to visit sick family members out of town, or the sudden need to take time off work when you have no annual leave available to tap into.

Without a Rainy Day Fund your ability to fund such things means taking on further debt or putting even greater pressure on meeting the day to day costs and life's normal expenses.

Life has enough pressure without adding to it, building a Rainy day Fund is essential now more than ever.

Building a 'Rainy Day Fund' made simple

The Moneytrainer customised online planner simplifies the process of building a rainy day fund making it a normal part of your plan.

I designed it that way because it is the one thing every other budget planning tool leaves out, and the one thing that every plan needs.

Request a FREE DEMO and let me show you how easy it is to get started today or you can register here.